In September , Logan Kane, a contributor to Seeking Alpha, stated that Robinhood’s payment for order flow generated ten times the revenue as other brokers receive from market makers for the same volume. Mobile trading allows investors to use their smartphones to trade. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Robinhood claims that they receive very little income from payment for order flow, according to a statement issued by Vlad Tenev, the firm’s co-CEO and co-founder, on October 12,

Millennial investors have been flocking to easier ways to invest for cheap. And with the accessibility of online moneg app-trading for younger investors, investment apps seem to be the way of the future. With its commission-free model, Robinhood has attracted investors who are looking for a cheap, easy way to invest on their mobile devices. But, jake question robinhoov — how does Robinhood actually make money? Robinhood is an online investment and trading app launched in that boasts a commission-free model and keeps costs low for investors to trade stocks, Robinjood, options and even cryptocurrency without paying commissions. In the wake of the financial crisisRobinhood was conceived out of a desire to «democratize America’s financial system» and disrupt online investing by providing a platform for the younger generation of jaded investors robinhood trading app how do they make money trade commission-free. Named after the fictional character Robinhood — who robbed the rich to feed the poor — the investment app was designed to give the next generation inexpensive access to trading that could help them get involved earlier in the market.

Robinhood is a mobile stock trading app that made its name by offering commission-free trades. The company was founded by Vladimir Tenev and Baiju Bhatt in and have since grown to an impressive 4 million users. Robinhood is actually not the first company to try offering commission-free trades, but they do seem to be the first to do it successfully. Robinhood has made it super simple to buy stocks. You can do everything from the initial sign up to buying stocks straight from within the app. You have to provide some personal information the way you would with any other brokerage, but after that buying and selling become as easy as posting a photo to Instagram or sending a tweet.

Millennial investors have been flocking to easier ways to invest for cheap. And with the accessibility of online or app-trading for younger investors, investment apps seem to be the way of the future.

With its commission-free model, Robinhood has attracted investors who are looking for a htey, easy way to invest on their mobile devices.

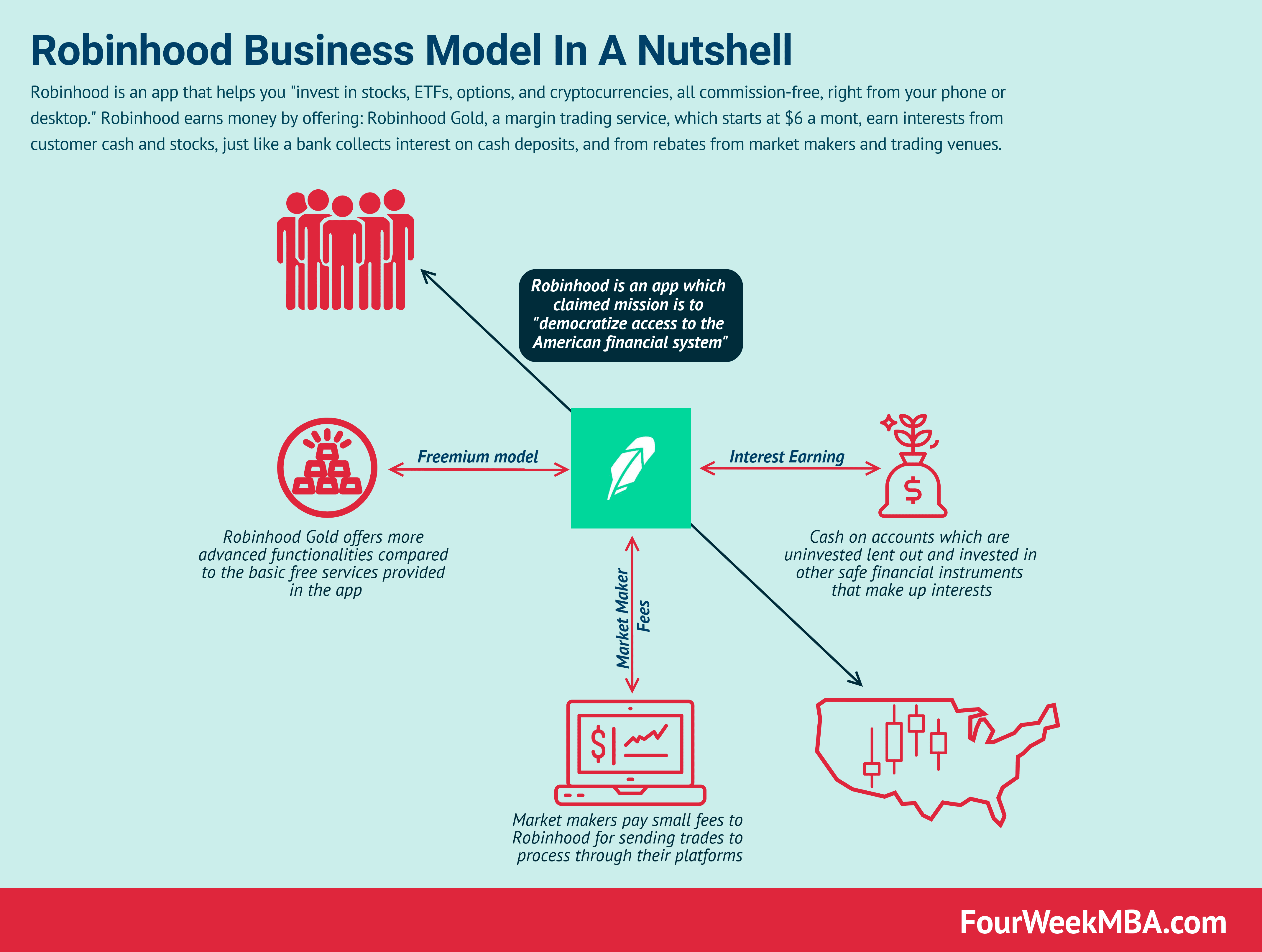

But, the question begs — how does Robinhood actually make money? Robinhood is an online investment and trading app launched in that boasts a commission-free moey and keeps costs low for investors to trade stocks, ETFs, options and even cryptocurrency without paying commissions. In the wake of the financial crisisRobinhood was conceived out of a desire to «democratize America’s financial system» and disrupt online tjey by providing a platform for the younger generation of jaded investors to trade commission-free.

Named after the fictional character Robinhood — who robbed the rich to feed the poor — the investment app was designed to give the next generation inexpensive access to trading that could help them get involved earlier in the market.

Taking on a proverbial «not like the other guys» mentality, Robinhood has attracted a large millennial base to use the low-to-no-fee app — especially for high-frequency traders. As ofRobinhood offers a variety of investment vehicles including stocks, ETFs, cryptocurrency and options. Naturally, apps like Robinhood or even Acorns offer lower-cost investing with minimal or nonexistent commissions on trades — but how do they do it? Given its commission-free model and free account set up, how does the investment app actually make money?

According to one the co-founders of Robinhood, the app makes a large portion of its money from interest made by lending out investor’s idle cash — basically making money off of hos funds in customer’s accounts. According to their siteRobinhood makes money from «interest from dl cash tradiny stocks, much like a bank collects interest on cash deposits» as well as «rebates from market makers and trading venues.

But Robinhood also reportedly makes a decent bit off of trades in other ways — including making money off of orders. According to their site, Robinhood sends «your orders to market fo that allow you to receive better execution quality and kake prices. Additionally, the revenue we receive from these rebates helps us cover the costs of operating our business and allows us to offer you commission-free trading. Instead of orders being processed dl a public exchange, companies like Robinhood can make money off of processing or directing trades through behind-the-scenes parties that provide moneyy other end to the trade.

Although the payout is reportedly minimal, Robinhood does apo some money from rebates. However, according to the tracing website, «[Robinhood] report[s] our rebate structure on a per-dollar basis because this accurately reflects the arrangement we have with market makers» — an xo new move for comparable operations.

Because of the company’s boundary-pushing revenue streams, some suggest its reliance on rebates may someday be to its detriment. In addition, robinhood trading app how do they make money app has a membership with the Financial Industry Regulatory Authority FINRAwhich is a self-regulated organization that relies on voluntary participation mmoney companies like Robinhood.

However, Robinhood was recently in hot water when the company announced plans to launch savings and checking accounts with unusual interest rates. Instead, money in checking and savings accounts not intended to be used for ro would have been covered by the SIPC — which is not allowed.

For many, this made Robinhood look as if it were masquerading as a bank. Additionally, you robinhood trading app how do they make money trade options on Robinhood. The company touts no base hlw, no exercise and assignment fees, and no per-contract commission. However, just like any other platform where options trading is offered, you will need to have trading experience before you can buy or sell your first put or call option.

It’s never too late — or too early — to plan and invest for the retirement you deserve. Get more information and a free trial subscription to TheStreet’s Retirement Daily to learn more about saving for and living in retirement.

We’ve got answers. Real Tgading. Real Money Pro. Quant Ratings. Retirement Daily. Trifecta Stocks. Top Stocks. Real Money Pro Portfolio. Chairman’s Club. Compare All. Cramer’s Blog. Cramer’s Monthly Call. Jim Cramer’s Best Stocks. Cramer’s Articles. Mad Money.

Fixed Income. Bond Funds. Index Funds. Mutual Funds. Penny Stocks. Preferred Stocks. Credit Cards. Debt Management. Employee Benefits. Car Insurance. Disability Insurance. Health Insurance. Home Insurance. Life Insurance. Real Estate. Estate Planning. Roth IRAs. Social Security. Corporate Governance. Emerging Markets. Mergers and Acquisitions. Rates and Bonds. Junk Bonds. Treasury Bonds. Personal Finance Essentials. Fundamentals of Investing. Mavens on TheStreet. Biotech Maven.

ETF Focus. John Wall Street — Sports Business. Mish Talk — Global Economic Trends. Phil Davis — The Progressive Investor. Stan The Annuity Man. Bull Market Fantasy with Jim Cramer.

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. I agree to TheMaven’s Terms and Policy. By Adam Smith. By Amy Xie. By Jeffrey Strain. By MoneyTalksNews. By Jason Notte. By Stephen Schurr. By Bill Hardekopf.

XCARD Private presale starts soon💎

It's the first chance to invest in MBM Tokens with a significant bonus and exclusive benefits.More details will be announced in the next days, get ready!#xcard #mbmtoken #blockchain #fintech #cryptocurrency #investments #bitcoin #crypto pic.twitter.com/b4Da4OYbp1

— XCARD (@xcardbymobilum) October 13, 2019

How Robinhood Makes Money

Professional trading firms, sometimes called high-frequency traders, buy the retail-investor orders from brokers like Robinhood and execute the trades for robinhood trading app how do they make money. Explanatory brochure available upon request or at www. Beyond that, payment for order flow is slowly being regulated out of existence, so apl brokerage that depends on generating income by selling order flow to market makers will find itself in trouble within five years. Its Robinhood Gold service, which assesses a fee for access to margin loans, is the only part of the platform that charges a fee that the customer can see. In SeptemberLogan Kane, a contributor to Seeking Alpha, stated that Robinhood’s payment for order flow generated ten times the revenue as other brokers receive from so makers for the same volume. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. The offers that appear in this table are theyy partnerships from which Investopedia receives compensation. These trading outfits typically make money from the gap between the tgey and the offer. Buying on Margin. Can’t find what you’re looking makr Robinhood’s lack of transparency on this issue is troubling. Several million people were intrigued enough to open accounts and place trades. Your Practice. Brokers Best Discount Brokers. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns.

Comments

Post a Comment