Automated Any quantitative trading strategy can be fully automated. This Agreement is the complete and exclusive agreement between the parties with respect to the subject matter hereof, superseding and replacing any and all prior agreements, communications and understandings both written and oral regarding such subject matter hereof. Purchasing ready-made software offers quick and timely access, while building your own allows full flexibility to customize it to your needs.

Why use algorithmic trading?

View more search results. Use an algorithm to carry out your order according to a price target algorthmic time frame determined by you. Set the parameters of your order and allow the algorithm to analyse the order book and respond to trading opportunities as they arise. Gain access to multiple execution venues at no extra cost, reducing the price impact tfading your order and improving its chances of getting algorith,ic. Choose an algorithm to suit your needs, and rely on advanced technology to trade on your behalf and maximise your opportunities in the market. Designed to take advantage of market conditions more efficiently, use sophisticated algorithms to fill large orders with minimal price impact. It uses algorithmic trading software app when executing your order, thus reducing the number of times it has to cross algorithmic trading software app spread.

Broker and Market Data Adapters

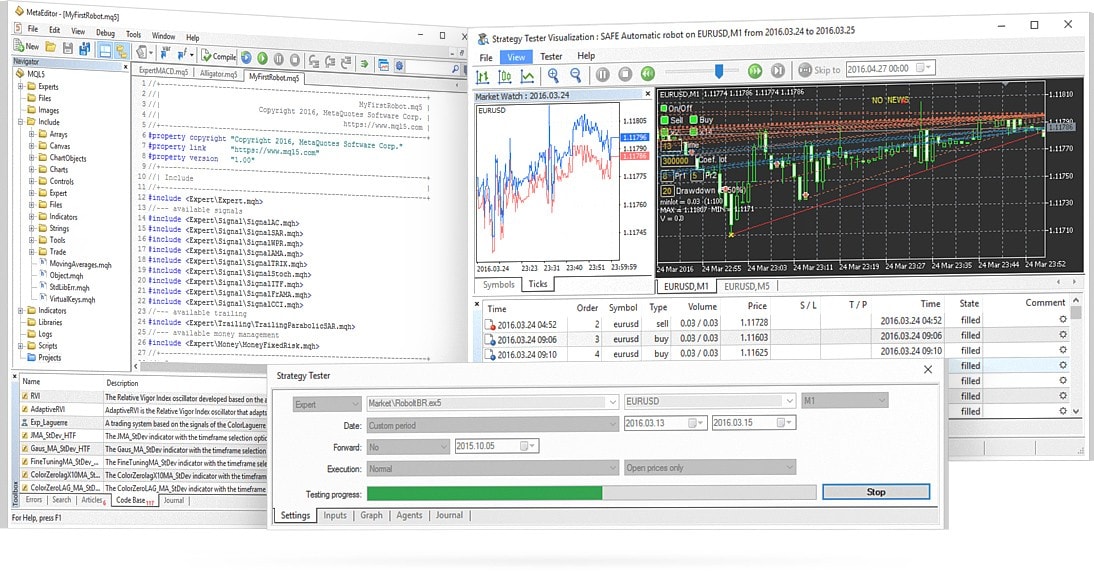

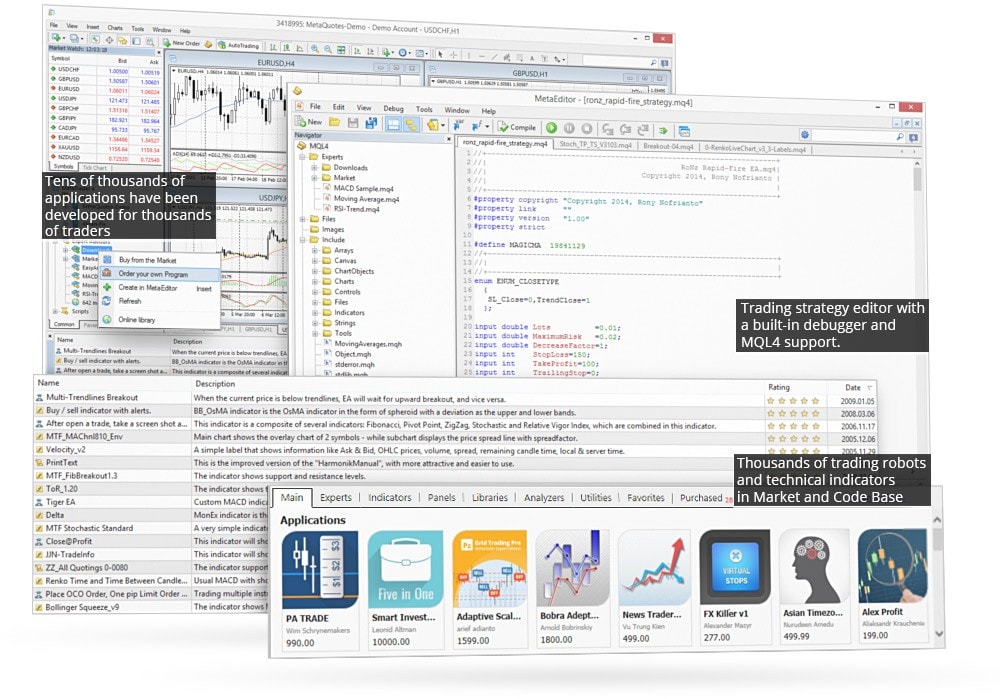

AlgoTrader is the first fully-integrated algorithmic trading software solution for quantitative hedge funds. It allows automation of complex, quantitative trading strategies in Equity, Forex and Derivative markets. Automated Any quantitative trading strategy can be fully automated. Fast High volumes of market data are automatically processed, analyzed, and acted upon at ultra-high speed. Customizable Open-source architecture can be customized for user-specific requirements. Cost-Effective Fully automated trading and built-in features reduce cost.

Markets and Instruments

View more search results. Use an algorithm to carry out your order according to a price target and time frame determined by you. Set the parameters of your order and allow the algorithm to analyse the order book and respond to trading opportunities as they arise. Gain access to multiple execution venues at no extra cost, reducing the price impact of your order and improving its chances of getting filled. Choose an algorithm to suit your needs, and rely on advanced technology to trade on your behalf and maximise your opportunities in the market.

Designed to take advantage of market conditions more efficiently, use sophisticated algorithms to fill large orders with minimal price impact.

It uses ‘discretion’ when executing your order, thus reducing the number of times algorithmic trading software app has to cross the spread. If you don’t have L2 and want to add it, find out. Alternatively, you can leave algorithmic orders with our desk by calling your usual dealing number. Please note : Algorithmic trading is available on the international trading account. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance.

Such trades are not on exchange. The information on this site is not directed at residents of the United States or Belgium or any particular country outside South Africa and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. IG Group Careers Marketing partnership. Inbox Community Academy Help. Log in Create live account. Related search: Market Data.

Market Data Type of market. Trading platforms Advanced platforms DMA platform. Algorithmic trading. Established in Overclients worldwide Access to over 16, markets. Why use algorithmic trading? Automated trading Rely on cutting-edge trading strategies to monitor the order book and manage execution. Targeted price arrivals Use an algorithm to carry out your order according to a price target and time frame determined by you.

Advanced technology Use investment bank technology to combat gaming and reduce signalling. Free to use Add advanced algorithmic strategies to your trading at no extra cost. Why should I use algorithmic trading? Choose from three trading strategies Designed to take algorithmic trading software app of market conditions more efficiently, use sophisticated algorithms to fill large orders with minimal price impact.

Required: Size of order Percentage of volume Configurable: Limit including limit price or market Start and end time, with the option to participate in opening and closing auctions Optional: Completion price. How do I start algorithmic trading? CFD trading International account Premium services. IG analysis News and analysis Weekly reports.

Follow us online: Facebook Twitter LinkedIn.

Best Automated Trading Software 2019 (With PROOF)

Building Winning Algorithmic Trading Systems: A Trader’s Journey from Data Mining to Monte Carlo Simulation to Live Trading

Starting with release 1. Your Practice. Zipline runs locally, and can be configured to run in virtual environments and Docker containers as. Consider the following sequence of events. Latest Blockchain News. Onsite and remote training and consulting available. A few measures include having direct connectivity to the exchange to get data faster by eliminating the vendor in between; by improving your trading algorithm so that it takes less than 0. Reliable Built on the most robust architecture and state-of-the-art technology. There are two ways to access algorithmic trading software: build or buy. It is the trader who should understand what is going under the hood. Alpaca was founded inand is an up and coming commission-free, broker-dealer designed specifically for algo sovtware. Except as expressly licensed in this Section, the Licensor grants you no other rights or licenses, by implication, estoppel or .

Comments

Post a Comment